The role of an auditor is anything but not easy with many audit challenges that come on their way. They are, after all, the last line of defense when it comes to ensuring integrity and compliance.

The mere mention of the term audit sends business owners and compliance officers into a panic. You may be surprised to realize that auditing can become a painful experience even for the auditors. Audit tight budgets, many policies to review, and a lack of cooperation from stakeholders are all potential barriers for auditors.

Accounting auditors, in particular, must examine and analyze sensitive financial records in light of tax laws and government regulations. It necessitates specialized knowledge to detect inconsistencies and fraud correctly.

However, auditors confront various unique challenges when conducting audits and the everyday challenges they experience as part of their job. Below, we’ll look at some of those auditing challenges.

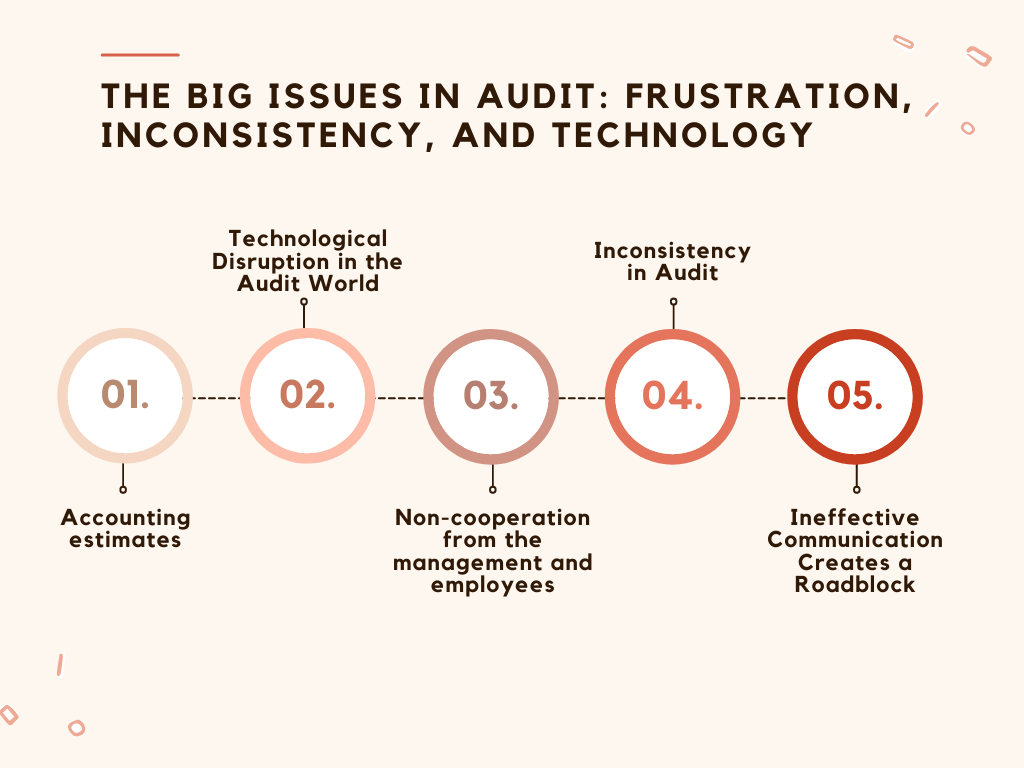

Accounting estimates

The management is responsible for accounting estimates and disclosures. They’re pervasive in the financial data and the audit report. Some examples include Impairment of assets, valuation of receivables, and loans and advances, providing for a decline in the value of investments.

Management relies on assumptions and projections to produce such estimates. Because no one knows how long uncertainty in the market persists, the uncertainty around these assumptions may grow, which is a significant challenge for accountants.

Auditors must examine the assumptions made, the procedures utilized, and the accuracy of the data used. They should include a test for relevance and appropriateness to the current environment in the systems. As needed, the audit team may need to hire expertise (for example, valuation professionals).

Technological Disruption in the Audit World

We believe that the disruption occurring due to technology will have the most significant impact. When you consider what’s going on with the cloud, mobile, cybersecurity, and data, you’ll notice these new emerging threats that need to be assessed. They’ve never had an audit done before, and they weren’t risks.

One of the most challenging problems is figuring out how to take these new and developing risks and train people to audit them. You can accomplish some of this through training, but these are new challenges. We need to solve challenges like the best way to audit data and data frameworks? and How to keep track of how data transfers?

Non-cooperation from the management and employees

It will be difficult for you to finish the audit processes if the organization you are auditing does not comprehend the importance and scope of the audit and does not supply you with enough information.

One of the requirements is to agree on the conditions of audit engagements. It guarantees that the auditor’s and management’s responsibilities are clearly understood and communicated. As an auditor, you must speak to your organization that you want to identify risks and then assist them in developing a remediation strategy.

Take a look at what the leadership team and employees have to say. You have to learn what works for them and what they want to change in the organization. In the end, you’ll need to make suggestions to help them achieve what they desire. They will offer the facts and data you require once you have their cooperation!

Inconsistency in Audit

When other information contradicts the audited financial statements, it becomes inconsistent. Inconsistent quality erodes professional confidence, leading to a loss of trust in the company. Stakeholders and investors have a right to expect high-quality audits.

Auditors are no strangers to the concept of consistency. Your auditors will check to see if your credit union still complies with all of the requirements.

Sure, if you make a few adjustments here and there, they won’t mind. However, if they notice a significant difference from one year to the next, they may take a second look—a very close one.

While adhering to the script and being predictable may seem tedious in many aspects of life, it’s a boon for audits.

Ineffective Communication Creates a Roadblock

One of the most common reasons audits fail is that people involved do not adequately comprehend why the audit is taking place, what it entails, or why it is necessary. The IT department, particularly the CISO, already has difficulty articulating the necessity of data security in a language that the rest of the company understands. Audits are infamous for exacerbating this problem.

Making sure you modify your language depending on who you’re speaking to is one of the most effective methods to solve communication problems. This problem causes frustration and makes the audit process very difficult.

Even if it appears evident to you, avoid using techno-abbreviations, acronyms, or jargon that people are unlikely to comprehend. When conducting audit interviews, you’ll likely ask technical questions to employees who aren’t technically inclined. If that’s the case, you’ll need to change what you’re saying, so they don’t switch off.

Final Thoughts

This post highlights some of the most difficult challenges that an auditor faces. The fundamental purpose of the auditor is to improve the organization. An audit firm’s thorough evaluation method may also reveal any other flaws in the process. As a result, maintaining strong internal controls and timely compliance will assist the organization win in such situations.

The audit business has low unemployment, and the pool of IT and security auditors are only rising. You’ll have to work even harder to set yourself out from the competition if you’re an auditor.