Whenever you hear the word ‘compensation’, you might think it begins and ends at an employee’s paycheck.

But in reality, the meaning of compensation goes far beyond the salary.

The compensation contains all the expenses an employer pay for each employee, such as health insurance, travel allowances, commissions, and other non-cash perks.

Here, understanding the meaning of compensation is very important to both the employer and the employees, so let’s understand in brief.

Table Of Content

- What is compensation – defined!

- What are the types of compensation?

- What are the compensation laws and regulations?

- What is the importance of compensation?

- Difference between base pay and compensation

- How to draft a Compensation Plan for Your Business

What is compensation – defined!

Basically, compensation is the total payment an employer makes or promises to make to an employee in exchange for their service or individual contributions to business.

Employee’s contribution can include their knowledge, skills, abilities, commitment to your business or project and so on.

Let me put this in simple words; compensation is the money given by an employer to the employee as a salary or wages, overtime, share options and so on.

Compensation doesn’t only mean a paycheck, but it is part of the paycheck.

Generally, the compensation comprises of many different types of elements which includes cash and non-cash payments.

Let’s have a look at the list of most common types of compensation,

- Base pay – hourly or salary wages

- Commissions and bonus

- Overtime pay, shift differentials and longevity pay

- Profit-Sharing distributions

- Incentive plan or achievement award

- Tip income

- Health and wellness benefits

- Stock options

- Gym memberships and free lunches

- Merit Pay or recognition

- Travel, Meal, Housing Allowance

- Child care and study assistance

- Employee assistance programs, including counselling, legal advice, and other services.

- Benefits including vacation, leaves, retirement, dental, insurance, medical, etc.

- Other non-cash benefits

Also, if you are planning to start a small business then bookkeeping business is the great choice, don’t forget to visit our blog how to start a bookkeeping business.

What are the types of compensation?

Direct financial compensation

Direct financial compensation is the most popular and well-recognized type of compensation.

Direct compensation is the payment directly paid to employees in exchange for their work.

Direct financial compensation can include everything from set salaries, tips, bonuses, wages and commissions.

Indirect financial compensation

Indirect financial compensation is the payment given to the employees who are not included indirect compensation.

Indirect compensation is often understood as the portion of an employee’s contract, which includes retirement plans, leaves of absence, and other benefits.

Non-monetary compensation

The non-monitory compensation is different from the direct and indirect one as it does not have included any monitory value.

These are the rewards that are not a part of an employee’s pay.

Non-monetary incentives are typically effective for employees who are comfortable with their salaries or have been in the position for a long time.

Non-monetary incentives are effective for employees who have been in the position for a long time or comfortable with their salaries.

Non-monetary incentives can include,

- Achievement awards

- Team leadership opportunities

- Personal days

- Prizes

- Paid training

- Gift cards

- New office or workspace upgrade

- Paid parking or transit passes

What are the compensation laws and regulations?

Compensation is governed by numbers of local, state, and federal regulations and laws.

Several compensation regulations govern how employers handle compensation, which is governed by local, state, employment and federal tax laws.

The Fair Labor Standards Act

Federal minimum wage laws are governed by the Fair Labor Standards Act (FLSA).

According to this, an employer must pay at least the prevailing minimum wage to their employees.

There are some other FLSA rules, such as the rules on child labour and overtime wages, including hiring teens and the child minimum wage.

Equal Pay Act

According to the Equal Pay Act, employers have to give equal pay to employees who do the same work regardless of their gender.

You will probably find many other federal, state, and local regulations that govern compensation, so if you are an employer, make sure you understand each and every responsibility if you are planning to hire an employer.

Federal, state, and local laws:

Some states dictate which benefits an employer should offer to their employees.

For example, according to The Affordable Care Act (ACA), employers offer health insurance to fifty or more full-time employees.

San Francisco requires 6 weeks of paid parental leave (increased to eight weeks in July 2020).

And Hawaii, California, New York, New Jersey, and Rhode Island require short-term disability insurance.

What is the importance of compensation?

Compensation is the most crucial element of running a business successfully and having the best compensation plan can help your organization thrive in this competitive market.

Let’s shed some light on the importance of compensation:

- Attracts top talent

- Motivates employees & boost loyalty

- Increases productivity & profitability

- Helps in retaining top employee

- Improves employee engagement & job satisfaction

- Helps stay in compliance with government

Difference between base pay and compensation

Base pay is the amount an employee receives on each paycheck for the period an employee worked; in other words, it is the minimum amount they are paid each pay cycle in exchange for their routine service.

But base pay does not contain any types of compensation.

For example, overtime pay or bonuses does not include in base pay but included in the employee’s total compensation.

The total compensation package is the money and perks each employee get from your business in exchange for their work.

Also, don’t miss our blog post what does a bookkeeper do to know the role of duties of a bookkeeper.

How to draft a Compensation Plan for Your Business

In order to attract and retain top talent in your business, having an appealing compensation plan in place can make all the difference.

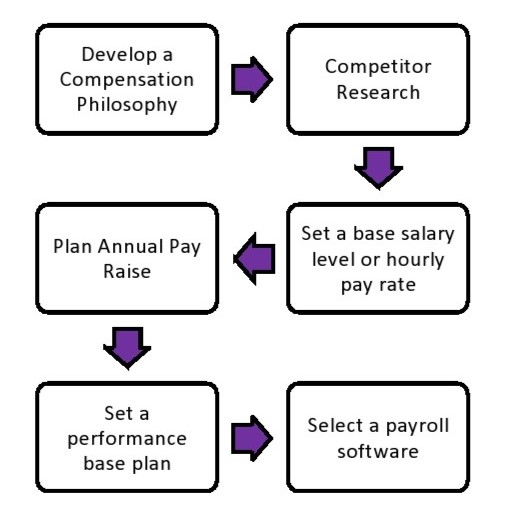

Creating a compensation plan is not straightforward, but here are some steps to get started:

1. Develop a compensation philosophy

Start with crafting a compensation philosophy that suits your business objectives, vision and missions.

A compensation philosophy should include commissions, base pay, tips, incentives, overtime and other compensations you to offer to your employees.

- Make a compensation committee that will decide the differences in payment structure for all employees in business – such as hourly, salaried, incentive-based, and non-contingent pay.

- Determine the balance between traditional compensation and its benefits.

- Decide if the company should have salaries above, below, or at the market level.

If you are just a beginner and learn how to do the payroll for business, then write down job titles and descriptions for all the essential positions for your business.

2. Competitor research

Research around and figure out how much compensation your competitors are offering to employees in a similar position.

For this, you can even take help from websites such as Glassdoor or PayScale, which can offer information by salary comparison, surveys in your city or state.

Also, keep in mind that just have ballpark figures for your budget before jumping to the next step.

3. Set a base salary level or hourly pay rate

In this step, set a base salary level or hourly pay rate for each position with the data you have in your hand from your earlier research.

Also, make sure that salaries should be competitive in your state, city or industry.

- Decide the number of levels – for example, beginner, intermediate, junior, and senior and establish a pay grade for each.

- Decide which jobs are benchmark jobs & what the standard market compensation is for them.

- Set up a salary structure.

- Find out the difference between salary steps & and the maximum-minimum per cent spread.

- Set up a salary administration policy.

Take advice from professionals when deciding whether to pay employees hourly or with an annual salary.

4. Plan annual pay raise

Investing in your employees will increase the profitability and productivity of your business as they are an integral part of the business.

To keep your employees motivated, have a plan for their annual pay raise and execute it; this will surely increase loyalty and performance.

5. Set a performance-based plan

Create an incentive or performance-based plan for top talent to motivate other employees to improve and increase their performance. Else, you can also offer periodic pay raises.

Create a performance-based or incentive plan for top performers to motivate other employees to improve and increase their performance. You can also offer periodic pay raise.

6. Select a payroll software

Now, this is the final step; in this step, select your payroll software and implement your compensation plan.

Also, have a look on the top accounting skills you need to master if you want to be an accountant.

Final thought

In summary, employee compensation is a crucial factor for any businesses and organizations, regardless of its size. So ensure that you draft a strategy that accurately reflects how you appreciate and values your work of your employees and grow and evolve with your business goals and priorities.