Almost every company doubts whether they are collecting and paying the correct sales tax to the tax authorities. There are different reasons for triggering a sales tax audit, and the most popular one is the constantly changing tax regulations in the country.

Tax is already something that business owners don’t like to hear, and encountering a sales tax audit is an unwelcome task for them. It requires time and effort to understand the changes in regulations and ensure paying the right taxes to the government, leading to cutting off time from core business activities.

Our guide will help you understand sales tax audits and their associated risks. We will also provide tips to recover from a sales tax audit or avoid making such errors.

Table of contents

- What is a sales tax audit?

- What triggers a sales tax audit?

- How do we resolve risks associated with sales tax audits?

- Final thoughts!

What is a sales tax audit?

A sales tax audit is an investigation of a business to check if they have collected and paid the right amount of sales tax owed to the state government for taxable transactions.

If the government suspects you of overstating or understating the business-reported sales on your sales tax return, you must undergo such a process. You call for an audit when your sales tax return filed with the state doesn’t match the Internal Revenue Service (IRS) report. An auditor will check all your financial statements to see if you are paying the state the right amount of sales tax and indicate any mistakes they found during the audit.

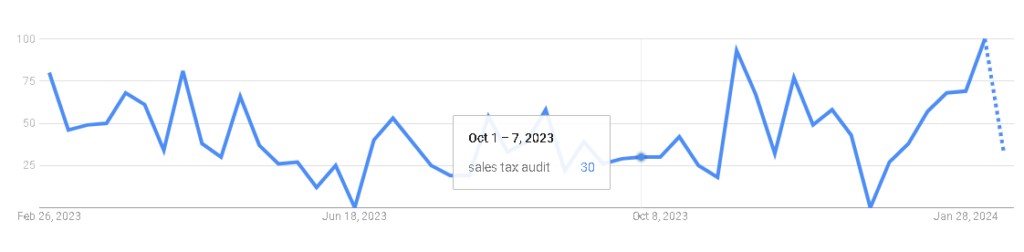

The graph below indicates the change in US sales tax audit demand for the past 12 months.

What triggers a sales tax audit?

A few reasons can trigger a sales tax audit in the US. Sometimes, you may not be at fault, but the state government monitors your business as it operates in a risky industry. We have listed a few reasons that can call for an audit, and you must stay prepared.

- The constant change in tax regulations

Tax regulations keep changing, which is a major cause for sales tax audits. You might not keep track of these changes or miss out on any new sales tax additions, resulting in mistakes while filing sales tax returns and paying incorrect taxes.

For example, if your company is expanding to a new market or opening a new business line, there might be some changes in the sales tax return filing requirements. If you are ignoring these government requirements, you will invite an audit.

- Not filing a sales tax return after registration

If you have registered your business with the Department of Revenue for submitting your sales tax but not filing your returns regularly, you can invite an audit. However, the government will first send you a warning notice, charge you a penalty, and then order an audit.

- Business making unusual revenue

If the state government finds out your business is making an unusual revenue compared to your competitors, a sales tax audit may be triggered. Otherwise, if your sales revenue goes above the threshold set by the government for changing tax regulations, and you aren’t aware of that, it may result in an audit.

- Addition of market facilitators

Sometimes, adding market facilitators may lead to problems with sales tax. If you sell a product directly from your official website, you must collect and pay the required sales tax. But, for market facilitators like Amazon they are responsible for collecting tax on your behalf.

Now, you cannot be sure that all the market facilitators will take this responsibility as no mandatory law exists. Therefore, if you aren’t asking the facilitator whether they will help in tax collection beforehand, you may invite a sales tax audit in future.

- Consumer complaints

Sometimes, customers complain about your business for collecting the wrong tax amount, which triggers an audit. Any clue about tax evasion or non-compliance from whistleblowers can result in a sales tax audit.

- Random selection of the government

If you are operating in a risky industry that often has a bad reputation for tax evasion, facing an audit is a must. You might not be at fault, but the tax authority checks you thoroughly to ensure you aren’t encouraging tax evasion or fraudulent activities in business.

How do we resolve risks associated with sales tax audits?

Sale tax audits can be an extremely difficult process for businesses. But you can prevent them by changing some of your habits.

Here are some tips to help you avoid sales tax audit risks.

- Automate accounting and tax processes

If you are calculating tax amounts manually, the chances of making errors increase. Therefore, you must automate all your accounting and tax processes and use human intelligence to make financial decisions.

By automating processes, you save time and money on repetitive tasks, prepare accurate sales tax returns, and stay updated with the changing tax compliance in the country.

- Know your tax liabilities properly

Some businesses may hide their real sales number to pay less sales tax. This way, you cannot save your pockets as the government can doubt your unusual revenue and ask for an audit. However, you can legally reduce your tax liabilities by talking to a CPA.

- File your tax return before the deadline

You need to give up on your habit of doing things late. If you constantly submit your sales tax return after the deadline, your chances of facing an audit increase.

Therefore, always remember the deadline for tax return submission and follow them accordingly.

- Understand your market facilitator policies

You must ask your market facilitator if they will collect taxes on your behalf for each sale made on their platform. This will help you stay assured of who is responsible for collecting and paying taxes, so there’s no confusion in the future.

- Get an updated exemption certificate

You must have an updated exemption certificate if your business sells exempt products. As a seller, you must know the requirements for different exemption forms. Otherwise, any error in them can invite an unexpected audit.

Additionally, if you are selling or purchasing a huge volume of exempt goods, there can be multiple reasons for an audit. Some of them are misinterpretations of the law, considering an exemption of an item in error, or non-compliance to regulations.

Final thoughts!

There can be multiple reasons for triggering a sales tax audit. But, it is not always bad for your business, especially when you follow best practices and comply with regulations. This guide gives you valuable tips on avoiding a sales tax audit, but you cannot eliminate it.

When your customers or suppliers are audited, you may also trigger an audit of their businesses. Therefore, you must stay prepared for audits, keep your financial documents handy, and hire an accountant to advise you.