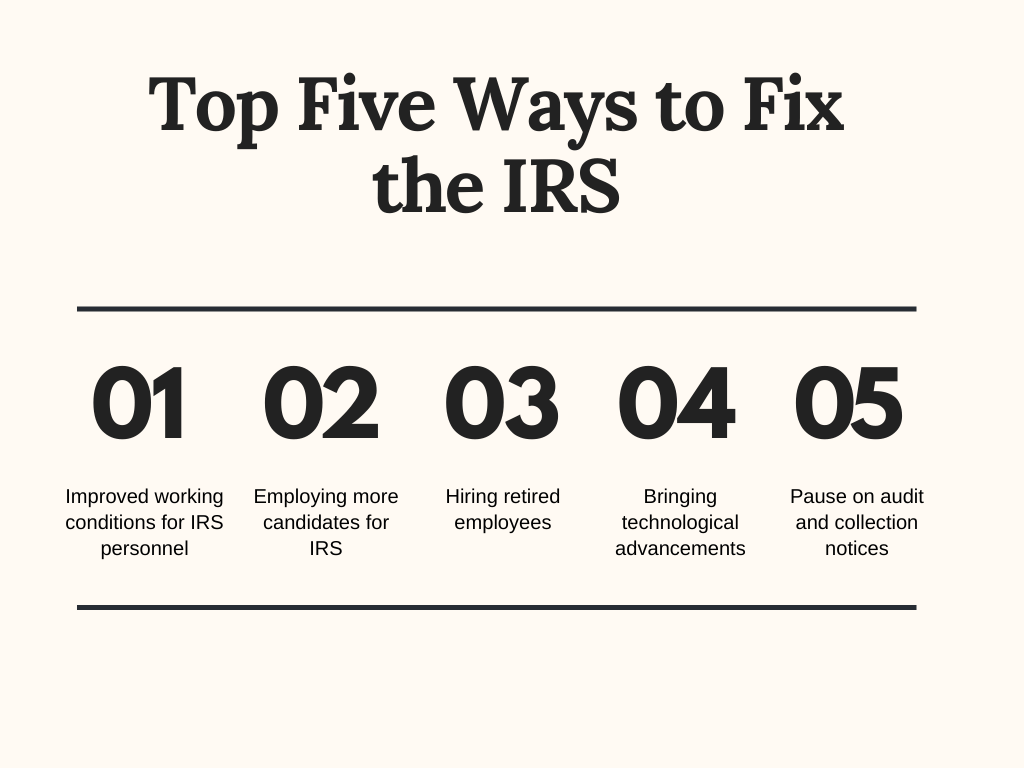

If there’s one thing we’ve learned in the last two years, the Internal Revenue Service is critical to our country’s economic health. Official IRS fillings from the Treasury and the IRS, including the national taxpayer advocate, are urging Americans to be patient and advocating for an increase in budget for IRS people and technology.

The IRS battled with antiquated processes for dealing with suspicious returns for the entire year of 2021. Even if 60 to 90 percent of returns and correspondence are incorrectly marked, this can cause significant delays, worsening return and correspondence processing backlogs.

According to the national taxpayer advocate, the IRS ended the year with 11.9 million unprocessed returns. The amount of in-process returns that have yet to be handled by an employee is unknown.

So, let’s check out what we should do this IRS filing season to assist taxpayers in minimizing, if not eliminating, the damage.

Improved working conditions for IRS personnel

IRS personnel are as crucial to the nation’s economic well-being as the healthcare workers are to its physical well-being, and they deserve to get the same treatment as them. IRS front-line employees, particularly those who process returns, open and process mail, and answer taxpayer calls, must be classed as essential employees.

IRS personnel performing these activities must report in person for complete shifts at IRS processing facilities, just as healthcare professionals must report in person to hospitals.

Because they are critical workers, the federal government should ensure their working conditions are as safe as possible. IRS personnel are tired from their heroic efforts over the last two years, but we need them back in the physical workplace to keep the economy of the United States afloat.

Employing more candidates for IRS

The filing season crisis requires an all-hands-on-deck response from IRS leadership. To clear the backlog of returns and correspondence, the agency must deploy all available staff, including those in centralized audit and collection functions.

According to the IRS commissioner, the agency is attempting to hire 5,000 customer support employees but has filled just 179 thus far. Because these recruits will need months of training, they will not be fully operational throughout the filing season. On the other hand, the IRS has employed many additional auditors and collection agents, already working on cases.

These personnel would be better used to analyze flagged returns and are awaiting a decision on whether or not they should be audited. They can also confirm identities, withholdings, and other potential filing bottlenecks.

Enforcement officers could begin their careers by directly observing the problems people experience in trying to comply with our complex tax rules. It’s a win-win situation for everyone.

Hiring retired employees

Over the recent two years, the IRS has experienced extraordinary retirements, with nearly 7,000 people leaving the agency. Some of these retirees, who worked in customer service and submission processing, may temporarily be persuaded to return in 2022.

Indeed, the IRS may continue to employ retired audit and collection employees to assist with the filing season. These retirees would require basic training and could be put to work right away.

If the IRS requires special recruiting approvals, the Office of Personnel Management should clear the way and devote the resources needed to perform background checks quickly. After all, these are crucial employees.

Bringing technological advancements

To eliminate manual tax return reviews, the IRS should use technology. During the last two years, IRS IT professionals have dedicated all their hard work towards it.

However, concentrating on tasks such as matching EIPs with rebate recovery credits or automating the look-back rules for refundable credits will free up front-line employees to respond to phones, process mail, and perform other tasks that computers cannot.

When taxpayers use the official apps, more helpful automated messaging may reduce some phone calls. It’s worth the extra effort to offer taxpayers this service.

Pause on audit and collection notices

The IRS should pause efforts that generate phone calls or correspondence, as urged by 21 senators, 191 representatives, and the American Institute of Certified Public Accountants.

While there is a pause on some notices to non-filers, a four-month suspension on audit and collection notices will free up resources for customer support operations and reduce the number of calls and mail that they should process during the filing season.

Final thoughts

Over the last year, much has been made about the widening tax gap and the IRS’s need for more money. Maintaining trust with the 160 million or more taxpayers attempting to comply with the tax regulations would prevent the tax gap from expanding any further.

Our modest and actionable recommendations will not cure all of the filing season’s challenges, but they will help. They would also show people that the IRS is attempting to ease their suffering.