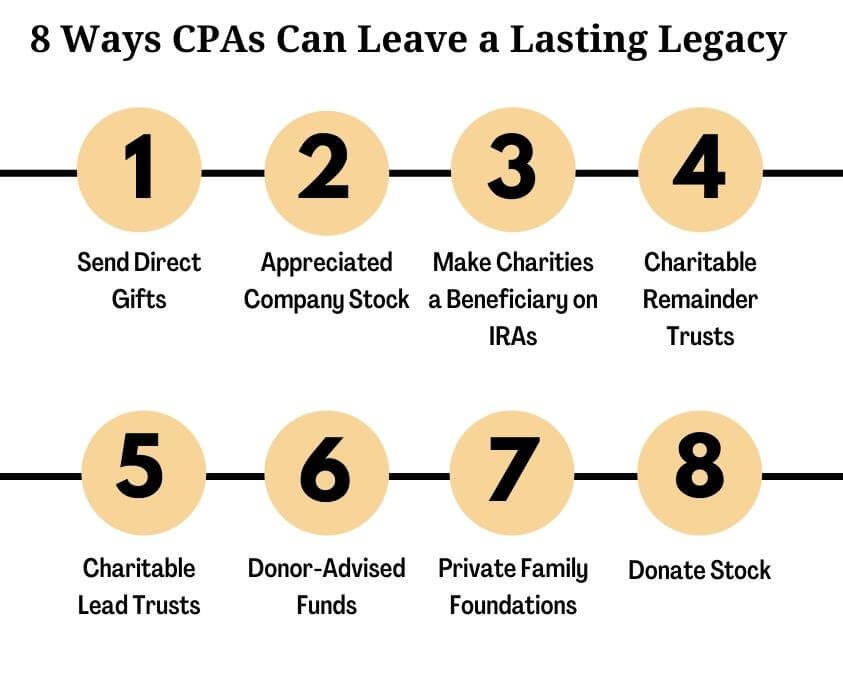

As a CPA, establishing a legacy may become more crucial as you gain experience. It’s reassuring to know that a part of you will live on when you retire. Your employees and colleagues will never forget you, but “legacy” includes more than just memories.

What may not seem important to you may be necessary to others. CPA near me can help you understand how to leave a long-lasting legacy. Consider how the strategies below can assist you in leaving a lasting legacy, as well as how they may apply to your clients.

Send Direct Gifts

You can give direct presents to others to share your wealth during your lifetime. The IRS also offers a gift tax exemption. The annual limit on these gifts is adjusted, and key figures to note in 2022 are:

- The maximum lifetime gift tax exemption is $12,060,000.

- Direct personal gifts are deductible up to $16,000 per recipient per year.

- Under current legislation, exemptions will shrink to $6 million by 2026

There are additional state-specific exemptions for gift taxes to consider. Remember that gifts made on someone’s behalf to charities, educational institutions, or medical facilities are all tax-free.

Appreciated Company Stock

You’ll eventually have to pay taxes on your stock ownership if the firm stock has appreciated. You should be aware of a tax method known as net unrealized appreciation (NUA) to reduce your tax burden.

This technique permits you to pay lower capital gains tax rates on tax-deferred assets rather than ordinary income tax rates.

How does this strategy work?

Simply put, you have two options when distributing business stock or cashing out your 401(k):

- Transfer it to another IRA or 401(k) plan, or

- Transfer the firm stock to a taxable account and the rest of the assets to an IRA or 401(k).

When comparing the two alternatives, the second one may be more cost-effective in tax savings.

When you move assets from a 401(k) plan to a taxable account, you usually have to pay income tax on the fair value of the assets. However, when it comes to corporate stock, you pay income tax on the cost basis of the stock.

When you sell your share in the future, you’ll have to pay long-term capital gains tax on the stock’s NUA. Given that the current capital gains tax rate is 20%, your potential tax savings could be significant compared to a top income tax rate of 37%.

Make Charities a Beneficiary on IRAs

According to the Secure Act, most IRA beneficiaries must remove the entirety of the funds within ten years after the account holder’s death. Individuals face the unavoidable task of paying income taxes on their withdrawals as they make them.

If you wish to leave a charitable legacy, you can designate a charity as a beneficiary of your IRA. Charities are tax-exempt, so these withdrawals will not be subject to income tax. Upon death, the amount left to the charity will also qualify for an estate tax deduction.

Charitable Remainder Trusts

Do you wish to leave money for a charity or a specific person? Consider making your IRA’s beneficiary a charitable remainder trust (CRT). Because CRTs are tax-exempt entities, they will receive funds at your death and will not have to pay any income taxes.

When one transfers money to the person designated in the CRT, they will be required to pay income taxes on the amount received. After the CRT terminates, the leftover funds are distributed to the chosen charitable beneficiaries.

Charitable Lead Trusts

A charitable lead trust is another option to consider. The purpose of these trusts is to reduce the beneficiary’s tax burden. A portion of the trust’s payments gets donated to charity for a fixed length of time, which is how these trusts work.

Beneficiaries gain access to:

- Deductions for charitable contributions

- Savings on estate and gift taxes

- Once they inherit the remaining balance, they reduce the amount of taxes they owe.

Donor-Advised Funds

DAFs (donor-advised funds) are another excellent way to leave a lasting legacy. A DAF is a charitable donation account set up at a public charity. Donors can then deposit assets into the account and, in most situations, claim an instant tax deduction.

Donors can deduct up to 30% of their adjusted gross income (AGI) for donations of non-cash assets owned for more than a year and up to 60% of their AGI for cash contributions on an annual basis. If you donate more than these levels, you can carry the excess forward five years.

Private Family Foundations

Another alternative is establishing (or contributing to) a private family foundation. The primary goal of a private family foundation is to make charitable donations.

Donors benefit in the following ways:

- How do donations get invested, and how are charitable gifts made.

- Contributions are immediately tax-deductible (subject to limitations) and reduction in taxable estates

- Avoiding capital gains tax on appreciated property contributions

Donate Stock

When it comes to donating corporate shares to charity, one of the most appropriate ways to leave a legacy is to donate assets. Stock donations benefit both the donor and the recipient. When you contribute stock, you get the following benefits:

- Capital gains tax avoidance

- Deducting stock donations from taxable income

- Increase your philanthropic impact

It makes sense to give shares as a gift. When you contribute stock to a charity, they receive the total value of the share, while you benefit from the tax benefits.

Final Thoughts

Legacy involves leaving an impact on the future and contributing to future generations. Though not everyone can leave a legacy on the world, you can consider a CPA for hire who can inspire you to reflect these characteristics in your daily lives and ensure that your actions benefit those around us. The eight approaches listed above can help you leave a legacy that earns money, preserves it, and gives back.